Hallo meet again with me sarta afdal, I will explain Blog I will introduce about Equity Base project For Everyone, and for more details let's just go to the following discussion:

Preliminary

Equitybase is an ecosystem of end-to-end commercial real estate properties for project evaluation, credit risk, liquidity, entirely on blockchain. Equitybase allows developers and fund managers to offer asset-backed investment opportunities to investors around the world.

Used in investments or trades when purchasing basic capital tokens at an equivalent cost, no freight cost on our platform. Participants worldwide will be able to use our platform to invest and diversify their portfolio, along with liquidity in the market, but generate revenue from the private market. With the support of our specialists with extensive experience and reputation in the real estate, consumer electronics and high-tech industries, we at Equitybase collect $ 300,000 round seeds. We create and publish high profile on the company website, with extensive experience in real estate and early operations over the past 15 years.

In the summer of 2018, full functionality will be launched on our Equitybase platform. Where each participant can invest in the field of commercial real estate together and receive dividends from the lease, we roll over with the asset satisfaction that will be perfectly passed on the contract and pay off the crypto or fiat currency along with its liquidity. traditional general market In autumn 2018, iOS and Android will be available to our platform users, with the full functionality of our site reliably on their mobile devices.

In simpler language - real estate exchange based on blockchain

What is the current investment model problem?

Liquidity to the Private Market (Equity investments have a long lock-up period of 3-10 years)

Availability of Financing (Developers can only obtain financing from within the country)

Borrowing costs (the interest rate depends on the region and the developer fund will be significant)

Entry barriers (Commercial investment requires a large amount of start ups)

Low Level of Return (stock market for the last 10 years averages 7% of profit per year)

High Management Costs (Private capital management costs range from 2-4% per annum)

What solution does this team offer the project?

World Access (Developers from around the world will be able to post their projects on the Investment Equity platform and raise enough capital easily)

There is no minimum investment (investors can invest a limited number of options without limiting investment)

Credit Rating System (Investors can track developer performance and track record)

Liquid Investment (our Exchange Platform offers the flexibility for investors to liquidate their assets for any investment)

Zero Investment Duty (the base of the token holder will be able to use the platform without commissions when dividends are received on the Joint Stock Fund)

Dividends and profitability targets (The volume of investments in commercial real estate offers a high rate of return and dividend databases for every asset class worldwide)

Roadmap:

3K / 2017

- Company Formation

- the formation of equity

- team building The first step in the development of platform architecture is equitybase.

4kV / 2017

- Financing

- Development

- Initial Capital: $ 300,000

- Start developing platforms

1Q / 2018

- Crowdsale

- Individual Pre-sales

- Pre-IKO

- Public IKO

- Demo version of the platform will be released

- Front-End and Back -And development, API testing

2K / 2018

- Dividend

- Platform Launch Platform

- beta version Invest Equity

- Exchange of basic marker lists

- Liquidity aggregation of multiple exchanges Crypto currency is created

3K / 2018

- Development

- User acquisition

- Launch Mobile App

- Partnership and attract users

- Detailed credit rating and reporting, integration

4kV / 2018

- Expansion

- Establish regional office in London, Shanghai

- Expansion of proposals for hedge funds and private equity funds

- IKO equity funds

- Change FIATA money instantly

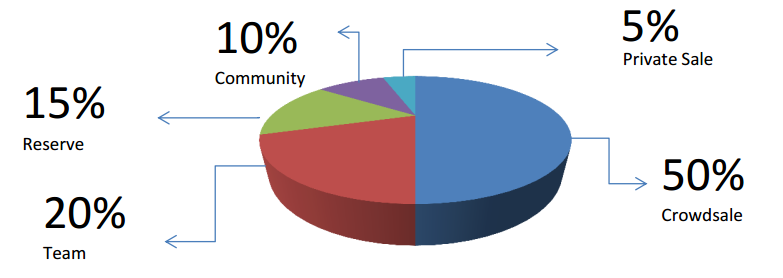

Token:

Marker symbol: BASE

Common shipping marker: 360,000,000 BASE

Rigid Restriction: $ 50.4 Million.

Marker Price: $ 0.28

Minimum purchase: None

Admission: Ethereal, Bank Transfer

ERC20 marker: yes

Individual Cover: None

Country permitted: Equitybase does not exclude people from any country to participate in our IRS. We, citizens, citizens, and Green Card holders need to confirm their rights as an accredited investor. All participants are invited to visit the country / region concerned to organize IKO. As an alternative to the provision of financial documents, US investors can be accredited if they can provide evidence that they have at least $ 1mm of crypto currency in the company.

Distribution:

180mm (50%) base must be allocated to the sales base of the marker.

72 mm (20%) reason to get into the wallet with a multi signature license and spend Equity for long-term investments and network updates.

48mM base (15%) will be used for backup

36MM (10%) of the base should be allocated to bounty and community-based, including consultants, home partners on the equity platform.

18mm (5%) of the base offer for personal pre-sale

Printah

MorganM. Chan

Founder / CEO

Sapphire capital partner's capital of a commercial real estate development company with $ 100 million under management. He started working and some IT and consumer electronics since 2000.

&

Connie Yiu

Founder / Marketing Director

Previously in the dollar shaving club as a manager of social networking, organize all aspects of social marketing. Unilever's DSC pickup in 2016 for $ 1 billion. Before the DSC, he was in newegg, as a marketing manager.

Lee Lois

Chief Counsel

Official source:

Website: https://equitybase.co

White Paper: https://equitybase.co/equitybasewhitepaper1.pdf

Twitter: https://twitter.com/equitybaseco/

Facebook: https://www.facebook.com/ equitybase /

Telegram: https://t.me/equitybase

Medium: https://medium.com/equitybase

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1409779

Author: sarta afdal17

My Eth: 0x77921cc7e185e9d57a27DB0adf45f07cC2e91034

Tidak ada komentar:

Posting Komentar