Hallo meet again with me sarta afdal, I will explain Blog I will introduce about CEYRON project, and for more details let's go to the following discussion:

Debit cards are also recognized as bank cards, plastic cards or check cards are plastic payment cards that can be used and not cash during purchase. It's like a credit card but unlike a credit card, it comes from a user's bank account when making a transaction. Some cards from a card can contain a stored value in which a payment is made, when most send a message to the cardholder's bank to remove funds from a bank account set by payer. In some cases, the main account is allocated exclusively for use on the Internet and there are no physical cards.

In many countries, the use of debit cards has become so widespread that their volumes have been thoroughly checked or replaced and in some cases cash transactions. The development of debit cards, unlike credit cards and credit cards, generally becomes a particular country that results in a number of different systems around the world, which are often incompatible.

Ceyron Finance Ltd, then CFL, intends to bring together the revolutionary blockgain industry and financial technology expertise. CFL disrupts two different worlds: Cryo and financial services ceyron.io will be a cryptocurrency-based investment platform with cryptocurrency trading terminal, debit card capabilities and token offerings that supported by a secure credit asset.CEY Token will enable the leading foreign exchange and asset management rates with a portfolio of secured, insured and robust asset returns that translate into increased stability for investors, the official site https://ceyron.io/

Ceyron is a decentralized exchange that seeks to improve the liquidity of crypto assets more transparent and safer than the centralized counterparts currently on the market today. Ceyron is an ecosystem built and operated by similar partner networks around the world in decentralization.

Network. The core is based on the highly efficient and secure Graphene Blockchain Library, capable of raising up to more than 100,000 trades per second with consensus proof of the delegated passage.Ceyron uses a high-speed LMAX matchmaking engine based on the graphene program to achieve matching capabilities of millions of transactions per second. The knot system will be an efficient and secure blockchain packing service through DPOS consensus. Going forward, scalability improvements will come from the adoption of EOS.

Identifying the Problem

-Low banking rate

African economies are strongly liquidated and have a very poor financial footprint. Less than 10% of adults have a bank account. The market is returning with cash transactions. For example, more than 85% of trade is cash.

-Highly competitive market

The mobile money environment in Africa is becoming increasingly competitive. This increasing competition means that consumers have more options.

-Very low usage rates

In the world, 12% of the account holders are in Africa. But the rates of inclusion in the financial system are very low. The behavioral analysis of the average paying user resembles a general trend: the withdrawal represents at least 60% of the transaction volume; peer-to-peer transactions 20%; 10% call duration, 8% payouts and 2% savings.

-The debit card usage is low.

Prepaid debit cards are used for POS (rare) shopping and services. However, CEY symbol owners have the privilege to receive annual dividends on CFL cards.

-The lack of safe and precarious credits for loan applicants.

In Africa, there is a lack of credit available for most applicants. CFL intends to solve this. More specifically, the CEY symbol can be regarded as a source of income that is distributed to entrepreneurs, because it is eligible for credit.

-Stable and sustainable income shortfalls for loan applicants

In Africa, there is a steady and sustainable income deficit in loan applications. With all of the above, it's clear what the problem is.

CFL Solution

CFL Credit Portfolio Fund, Colombus Investment Management Ltd. and primary assets are credit assets purchased from non-bank origins. Assets consist of mortgages, second mortgages, real estate bridge loans, automobile loans, equipment loans and leases, commercial mortgage loans, asset based credits and factoring contracts. Non-bank financial institutions form credit assets and generally retain all service responsibilities. The Fund will, from time to time, purchase credit assets in pools, in all separate credits or in all participations to the credits. In addition to paying a nominal service fee to fulfill the billing and collection function of receivers of typical creative credit assets, the loan will continue to be the primary service provider of the resource transfers, including any obligation to provide any special services. . The loans are up to date and fully reimbursed. In addition to the service function provided by the credit creators, in case one or more creators can not perform their duties, a secondary "backup" service task is activated. This ensures that cash collections and repayments of credit assets continue. Today, 60 percent of US mortgage lending is held by banks for 30 percent (30 percent) in 2013. It is held on bank credit platforms of hundreds of banks of US trillion US dollars alone on the US mortgage. The Fund Manager shall approve the debt payment and risk relating to the originating assets, origin, volume, coverage, time and fee to the regulatory compliance, management quality and service quality. The CFL portfolio CFL portfolio, as well as liquidating the highest risk assets of the CFL portfolio. The solution that Jeyran brought here.

-Simple and Fast

You can easily send Ceyron as an email. Where there is no point where you live, Ceyron can send and receive.

-Decentralized

We use decentralized block-chain technology, so there is no trusted third party. Transactions are made directly between users.

-It is unlimited

Ceyron will only supply 250 million dollars. For this reason, prices are on an upward trend when demand is high and the number of remaining funds does not increase.

Features of Jeyran's solution to this problem

-It is valuable.

From the moment you win CEY, the world opens to you.

-Ceyron is change.

Private Ceyron exchange website allows you to buy and sell CEY and other crypto currencies.

-Travel Spending

Life without mortar. Your card will always be regarded as a local currency card and you will get the perfect interbank exchange rate.

-Anonymous

Anyone can run your wallet and act with the same anonymity as Bitcoin.

-Easy Money Transfer

Just like Bitcoin, you can send whatever you want, wherever you want.

-No Barriers.

send and receive international payments without participant participation.

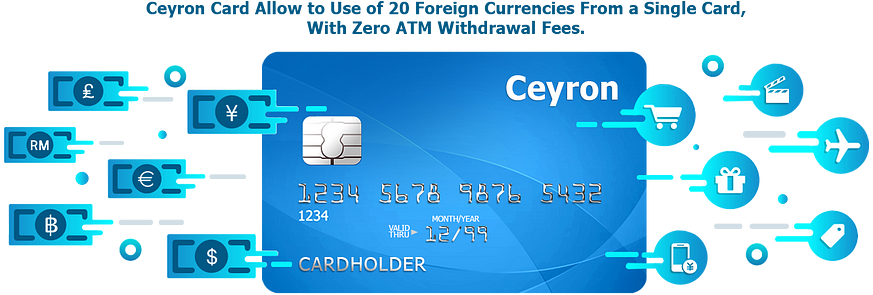

Ceyron card

CEYRON CARD COMES SOON ..!

The CEY card will become a physical, virtual and debit MasterCard with a mobile app that will allow the use of twenty (20) foreign currency from one card.

CEYRON DEBIT CARD AVAILABLE

With the capabilities of CHIP, most with Contactless technology. What does this mean? CHIP (also called EMV) is a technology to make your debit card much more secure and very difficult to copy or clone.

-Contactless (formerly called paypass) is a card technology that enables quick payment for small personal purchases at stores etc. Just by tapping or waving the card in the card terminal.

DIGIPASS AVAILABLE

This app can be downloaded for all Android, iOS and Windows smartphones from the official App Store and Google Play Store, making online banking as secure and providing more convenience than ever in many ways:

-Secure the modern technology available on your mobile device

-Easy activation by reading QR code

-Additional security through fingerprint protection (on supported devices)

-No need to bring additional tools to activate online banking

-There is no lifetime limit

-More flexibility for PIN management

-Manage more accounts with one app

CFL seeks to minimize the volatility of CEY Token by supporting its value through a portfolio of secured credit assets. In turn, the yield of the portfolio credit asset will be reinvested into the loan assets portfolio to try to improve the underlying fundamentals. value of each CEY Token. The portfolio of credit assets will then be secured with a guarantee to improve stability and return. Fund managers will use artificial intelligence and machine learning to build secure asset loan portfolios.

The clock watch technology has the potential to provide greater integrity, security, security, and transparency. Thus, CFLs will use blockchain to ensure immediate problem handling at low cost in the hope of providing greater liquidity to investors.

Token Name: Ceyron

Token Symbol: CEY

Contract Address: 0xebc71036a37451e87cc43af8ae7ac123aa750dcb Decimal

: 8

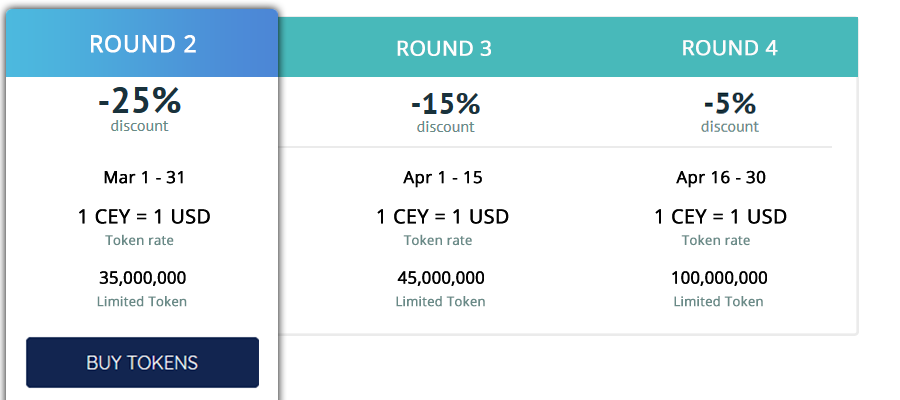

Price Per Token: $ 1.00 USD per CEY Token

Number of Tokens Sold: 250,000,000

Start Sale Pre-Token: february 16.2018

End of Pre-Sale Token: March 15, 2018

Pre-Sale Discount: 35%, 25%, 15%, 5%

Starting from Token Sales: March 16, 2018

Soft Cap: 2 Million USD

Hard Cap: 45 Million USD

End of Sale Token: When Hard cap is reached

Accepted Currency: BTC, ETH, LTC and USD

Starting from Bounty Registration: February 15, 2018

'Each time and date in the above scheduled time may change according to the absolute discretion of the CFL'

ROADMAP

-1st Quarter 2011

Create a secure loan portfolio with the fund;

Expect the plans and capabilities of the CEY Debit Card, integrating the strategic partners Debit Card with the CEY Debit Card, and expanding local fiat debit card capabilities, including crypto-purses;

Hire integrated engineers to create crypto exchange and Bank Card features.

Launch of the CEY Debit Card Program, which the CEY plans to open approximately fifteen thousand (15,000) to twenty thousand (20,000) cards worldwide.

-Quarter 2019

Complete the crypto exchange exchange and add cross-exchange trading capabilities, upgrade the markers listed on the stock exchanges to other ERC20 markers, and complete seamless integration of these exchange platforms into their debit cards.

-Quarter 2020

Create decentralized applications to facilitate payment of sales tax at point-of-sale terminals.

For more information, please visit the links below.

Website: https://ceyron.io/

Technical Report: https://ceyron.io/wp-content/uploads/2018/02/White-Paper-ICO-CEY-Token-UPDATED31012018.pdf

Facebook: https://www.facebook.com/Ceyron/

Twitter: https://twitter.com/cryronico

Instagram: https://www.instagram.com/cryronico/

Author : sarta afdal17

My Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1519661

My Eth : 0x77921cc7e185e9d57a27DB0adf45f07cC2e91034

Tidak ada komentar:

Posting Komentar